nojoke

06-23 03:38 PM

Here is one calculation that might give you one more reason to buy...

This is taking into consideration bay area good school district ....

say you are currently in a 2 bedroom paying around $1900 rent (say cupertino school district)

you buy a townhome for around $500k putting down 20%

so loan amount is 400k

@ 5% instrest your annual intrest is $ 20k.

Say 3k HOA anually...

Property tax....as a rule of thumb, I believe (and have heard from others) whatever poperty tax you pay comes back as your mortgage intrest and property tax is deductable.

So not taking property tax into account....your annual expense is 23k.

now here is the nice part....

you get 8k (or is it 7.5k ?) from FED for buying a house (first time buyer)

If you get a real estate agent who is ready to give you 50% back on the comission you can get back around 7.5k (assuming the agent gets 3% comission)...I know those kind of agent exist for sure !!

There is something I have heard about CA also giving you 10k for buying new homes...but I am not sure of this so will leave it out of the calculations...

so total amount u get back....8k+ 7.5k = 15k approx..

1st year expense = 23k

1st year actual expense = 23-15 = 8 k

which mean monthly rent = 8k/12 = $666 per month (it is like paying $666 rent for a 2 bedroom in cupertino school district)

Will the property value go up ? I do not know (I wish I knew)...

Is there a risk ? I would think yes....

Percentage of risk ? I would think keeping in mind current prices the risk is low...

I am not telling that you should buy or not buy....just provided one piece of the calculation....-;)

All the best !

All these calculations don't play out if the house price keeps dropping. It has gone down in value for the last couple of years. It will go down more until housing is affordable. Right now a million $ for a 3 bedroom in bay area is too much. It has to go down a lot and it will go down. So the question is not about rent vs owning cost. It is a question of how severe the housing price crash is going to be. One can convince themselves playing with numbers. But the fact is that the Alt-A loans are going to get hit in another year and all those shadow inventory that banks are hiding will be forced into the market eventually. By then these rent vs mortgage numbers would mean so little...

This is taking into consideration bay area good school district ....

say you are currently in a 2 bedroom paying around $1900 rent (say cupertino school district)

you buy a townhome for around $500k putting down 20%

so loan amount is 400k

@ 5% instrest your annual intrest is $ 20k.

Say 3k HOA anually...

Property tax....as a rule of thumb, I believe (and have heard from others) whatever poperty tax you pay comes back as your mortgage intrest and property tax is deductable.

So not taking property tax into account....your annual expense is 23k.

now here is the nice part....

you get 8k (or is it 7.5k ?) from FED for buying a house (first time buyer)

If you get a real estate agent who is ready to give you 50% back on the comission you can get back around 7.5k (assuming the agent gets 3% comission)...I know those kind of agent exist for sure !!

There is something I have heard about CA also giving you 10k for buying new homes...but I am not sure of this so will leave it out of the calculations...

so total amount u get back....8k+ 7.5k = 15k approx..

1st year expense = 23k

1st year actual expense = 23-15 = 8 k

which mean monthly rent = 8k/12 = $666 per month (it is like paying $666 rent for a 2 bedroom in cupertino school district)

Will the property value go up ? I do not know (I wish I knew)...

Is there a risk ? I would think yes....

Percentage of risk ? I would think keeping in mind current prices the risk is low...

I am not telling that you should buy or not buy....just provided one piece of the calculation....-;)

All the best !

All these calculations don't play out if the house price keeps dropping. It has gone down in value for the last couple of years. It will go down more until housing is affordable. Right now a million $ for a 3 bedroom in bay area is too much. It has to go down a lot and it will go down. So the question is not about rent vs owning cost. It is a question of how severe the housing price crash is going to be. One can convince themselves playing with numbers. But the fact is that the Alt-A loans are going to get hit in another year and all those shadow inventory that banks are hiding will be forced into the market eventually. By then these rent vs mortgage numbers would mean so little...

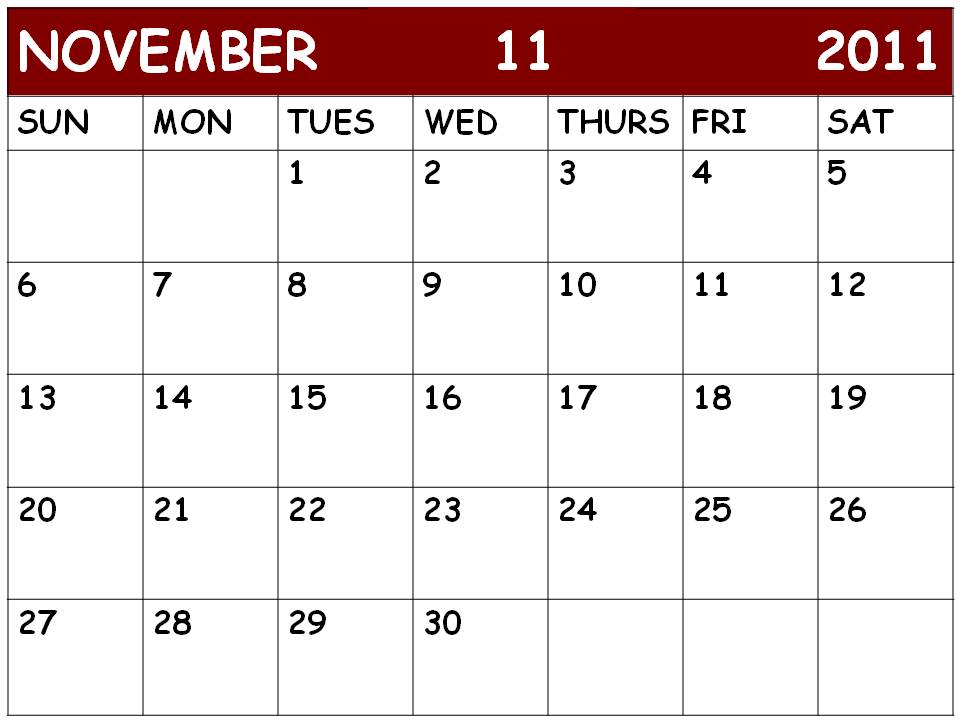

wallpaper 2010 calendar template

unitednations

07-19 02:07 PM

It looks like this thread has really started to make peope think of the "status issues".

A lot of people have sent me PM's to assist them. However; I can't take this off-line; therefore, please resist from sending me PM's.

Reason I participated in this discussion was to highlight some of the things that people should think of and determine best courses of actions.

attornies and the like are very busy doing their current work. There is a high chance that they may not do the proper due diligence or ask you the proper questions before they file.

You all need to have a very thorough discussion with your attornies and take second opinions where necessary. I can tell you that depending on your attornies case load; how many phone calls they are taking; they may provide you advice that would suit their own needs (ie., get you off the phone the quickest and let them carry on with their normal duties).

Unless the law changes; everyone will be stuck in retrogression for a long time. If UScis should pre-adudicate and deny 485's then you will lose the opportunity to re-file for quite some time.

This is an important topic as this is what uscis mainly looks at in the 485 stage. I suggest people discuss it with their attornies and make sure you have every situation covered before you file the 485.

A lot of people have sent me PM's to assist them. However; I can't take this off-line; therefore, please resist from sending me PM's.

Reason I participated in this discussion was to highlight some of the things that people should think of and determine best courses of actions.

attornies and the like are very busy doing their current work. There is a high chance that they may not do the proper due diligence or ask you the proper questions before they file.

You all need to have a very thorough discussion with your attornies and take second opinions where necessary. I can tell you that depending on your attornies case load; how many phone calls they are taking; they may provide you advice that would suit their own needs (ie., get you off the phone the quickest and let them carry on with their normal duties).

Unless the law changes; everyone will be stuck in retrogression for a long time. If UScis should pre-adudicate and deny 485's then you will lose the opportunity to re-file for quite some time.

This is an important topic as this is what uscis mainly looks at in the 485 stage. I suggest people discuss it with their attornies and make sure you have every situation covered before you file the 485.

ksvreg

03-24 02:17 PM

Dear Sledge_hammer,

Dont just hammer around. The people who are doing consulting is not doing it out of their choice. It is the economy it forced some of us into consulting (fulltime to the company we work for but work for a client). In 2001, when we came out of school and tech bubble burst, there was no fulltime jobs, we were forced to do consulting. Some of my freinds who graduated in 2000 got into microsoft, oracle, cisco who didnt had damn good GPA. The guys who had 4.0 GPA and graduated a semester later didnt get those offers, coz bubble burst by that time.

I am forced to tell you that the guys who are doing fulltime jobs working in same technology and same companies and doing same thing everyday are by no means smarter than the consultants who work in different industries, different technologies and enjoy their work. I would challenge the guys to come out and find a job faster than a consultant with same amount of experience.

Luck By Chance doesnt give them a right to cry foul on consultants everyday....I am really sorry if i hurt anybodys feelings. I was forced by some of our fellow members. You have lot of other things to talk about. Dont blame consultants for your misery. If you are destined to suffer, you will suffer one or other way.

I would advice all FTE's to be prepared for unexpected twists and turns in bad economy.

You are right.

Let us not to pull the legs of each other.

Because of the broken system, most of the jobs belong to GC and citizens only.

How GC and citizenship awarded? By virtue of skills? experience? education qualification?

It was awarded through broken system. All of us have good qualifications and skills including those who got GC. This broken system teasing us.

Dont just hammer around. The people who are doing consulting is not doing it out of their choice. It is the economy it forced some of us into consulting (fulltime to the company we work for but work for a client). In 2001, when we came out of school and tech bubble burst, there was no fulltime jobs, we were forced to do consulting. Some of my freinds who graduated in 2000 got into microsoft, oracle, cisco who didnt had damn good GPA. The guys who had 4.0 GPA and graduated a semester later didnt get those offers, coz bubble burst by that time.

I am forced to tell you that the guys who are doing fulltime jobs working in same technology and same companies and doing same thing everyday are by no means smarter than the consultants who work in different industries, different technologies and enjoy their work. I would challenge the guys to come out and find a job faster than a consultant with same amount of experience.

Luck By Chance doesnt give them a right to cry foul on consultants everyday....I am really sorry if i hurt anybodys feelings. I was forced by some of our fellow members. You have lot of other things to talk about. Dont blame consultants for your misery. If you are destined to suffer, you will suffer one or other way.

I would advice all FTE's to be prepared for unexpected twists and turns in bad economy.

You are right.

Let us not to pull the legs of each other.

Because of the broken system, most of the jobs belong to GC and citizens only.

How GC and citizenship awarded? By virtue of skills? experience? education qualification?

It was awarded through broken system. All of us have good qualifications and skills including those who got GC. This broken system teasing us.

2011 These calendar templates are

Macaca

12-29 07:31 PM

Suicides in India Revealing How Men Made a Mess of Microcredit (http://washpost.bloomberg.com/Story?docId=1376-LE3PZI1A1I4H01-0F7HGVAGBBTBG4G4S2I5PL8TJ5) By Yoolim Lee and Ruth David | Bloomberg

Tanda Srinivas was lounging in the yard of his two-room house in the southern Indian village of Mondrai shortly after noon on Oct. 28 when his wife, Shobha, burst out of the door covered in flames and screaming for help.

The 30-year-old mother of two boys had poured 2 liters of kerosene on herself and lit a match. The couple had argued bitterly the day before over how they would repay multiple loans, including those from microlenders who had lent small sums to dozens of villagers, says Venkateshwarlu Masram, a doctor who called for the ambulance.

Shobha, head of several groups of women borrowers, was being pressured to pay interest on her 12,000 rupee ($265) loan. Lenders also were demanding that she cover for the other women, even though the state had restricted microfinance activities two weeks earlier, Bloomberg Markets magazine reports in its February issue.

When Srinivas, 35, tried to snuff out the flames with a blanket, his polyester clothes caught fire. Within three days, both parents were dead, leaving their sons orphans.

Now, on this November morning, the boys� ailing 70-year-old grandfather and blind grandmother say they are caring for Aravind, 10, and Upender, 13, in the farming village where many men earn a living gathering palm extract to make alcoholic beverages.

None of the boys� relatives can support them full time, says their 60-year-old grandmother, Saiamma, breaking into tears.

India�s Microlending Hub

The horrific scene in Mondrai, 80 kilometers (50 miles) from the city of Warangal, has played out in dozens of ways across Andhra Pradesh, India�s fifth-largest state by area and the site of about a third of the country�s $5.3 billion in microfinance loans as of Sept. 30.

More than 70 people committed suicide in the state from March 1 to Nov. 19 to escape payments or end the agonies their debt had triggered, according to the Society for Elimination of Rural Poverty, a government agency that compiled the data on the microfinance-related deaths from police and press reports.

Andhra Pradesh, where three-quarters of the 76 million people live in rural areas, suffered a total of 14,364 suicide cases in the first nine months of 2010, according to state police.

A growing number of microfinance-related deaths spurred the state to clamp down on collection practices in mid-October, says Reddy Subrahmanyam, principal secretary for rural development.

�Every life is important,� he says.

Perverse Turn

On Nov. 8, police arrested two managers of lender Share Microfin Ltd. on allegations of abetting another suicide, this one of a 22-year-old mother. Share Microfin didn�t respond to requests for comment on this story.

As India struggles to provide decent education, health care and jobs to millions still locked in poverty, microlending -- the loaning of small sums to the world�s neediest people to help them earn a living -- has taken a perverse turn.

Microcredit has become �Walmartized� by unrestrained selling of cheap products to the poor, says Malcolm Harper, chairman of ratings company Micro-Credit Ratings International Ltd. in Gurgaon, India.

�Selling debt is like selling drugs,� says Harper, 75, the author of more than 20 books on microfinance and other topics. �Selling debt to illiterate women in Andhra Pradesh, you�ve got to be a lot more responsible.�

Opposite Effect

K. Venkat Narayana, an economics professor at Kakatiya University in Warangal, has studied how microfinance lenders persuaded groups of women to borrow.

�Microfinance was supposed to empower women,� he says. �Microfinance guys reversed the social and economic progress, and these women ended up becoming slaves.�

India�s booming microlending industry is part of a global phenomenon that began as a charitable movement but now attracts private capital seeking growth and high returns.

Banco Compartamos SA, a former nonprofit that�s now the largest lender to Mexico�s working poor, raised about $467 million in its 2007 initial public offering. The August IPO of SKS Microfinance Ltd., India�s biggest microlender, drew further attention to the industry.

SKS began operating in 1998 as a nongovernmental organization led by Vikram Akula, 42, an Indian-American with a Ph.D. in political science from the University of Chicago.

The company raised 16.3 billion rupees by selling 16.8 million shares at 985 rupees each. SKS shares peaked at 1,404.85 rupees on Sept. 15. As of Dec. 28, they�d fallen to 652.85 rupees.

Andhra Pradesh Crisis

On Oct. 15, the government of Andhra Pradesh imposed restrictions that bar microlenders� collection agents from visiting borrowers and required companies to get local authorities� approval for new loans. The rules have crippled lending and repayments. Loan collection levels in the state have dropped to less than 20 percent from 98 percent previously, according to an industry group.

The upheaval in Andhra Pradesh is a long way from the vision of Muhammad Yunus.

The former economics professor won the Nobel Peace Prize in 2006 for his pioneering work in Bangladesh providing small sums to entrepreneurs too poor to get bank loans.

Yunus, 70, discovered more than three decades ago that when you lend money to women in poverty, they can begin to earn a living, and most of them will pay you back.

Yunus started the Grameen Bank Project in 1976 to extend banking services to the poor. Since then, it has lent $9.87 billion and recovered $8.76 billion; 97 percent of its 8.33 million borrowers are female.

�Wrong Direction�

Yunus says he�s not against making a profit. But he denounces firms that seek windfalls and pervert the original intent of microfinance: helping the poor.

The rule of thumb for a loan should be the cost of funds plus 10 percent, he says.

�Commercialization is the wrong direction,� Yunus says, speaking in a telephone interview from Bangladesh�s capital of Dhaka. �An initial public offering is the triggering point for making a lot of money personally as well as for the company and shareholders.�

David Gibbons, chairman of Cashpor Micro Credit, a nonprofit microlender to the poorest women in India�s Uttar Pradesh and Bihar states, says public, for-profit lenders face a conflict.

�They have to decide between the interests of their customers and interests of their investors,� he says.

Tanda Srinivas was lounging in the yard of his two-room house in the southern Indian village of Mondrai shortly after noon on Oct. 28 when his wife, Shobha, burst out of the door covered in flames and screaming for help.

The 30-year-old mother of two boys had poured 2 liters of kerosene on herself and lit a match. The couple had argued bitterly the day before over how they would repay multiple loans, including those from microlenders who had lent small sums to dozens of villagers, says Venkateshwarlu Masram, a doctor who called for the ambulance.

Shobha, head of several groups of women borrowers, was being pressured to pay interest on her 12,000 rupee ($265) loan. Lenders also were demanding that she cover for the other women, even though the state had restricted microfinance activities two weeks earlier, Bloomberg Markets magazine reports in its February issue.

When Srinivas, 35, tried to snuff out the flames with a blanket, his polyester clothes caught fire. Within three days, both parents were dead, leaving their sons orphans.

Now, on this November morning, the boys� ailing 70-year-old grandfather and blind grandmother say they are caring for Aravind, 10, and Upender, 13, in the farming village where many men earn a living gathering palm extract to make alcoholic beverages.

None of the boys� relatives can support them full time, says their 60-year-old grandmother, Saiamma, breaking into tears.

India�s Microlending Hub

The horrific scene in Mondrai, 80 kilometers (50 miles) from the city of Warangal, has played out in dozens of ways across Andhra Pradesh, India�s fifth-largest state by area and the site of about a third of the country�s $5.3 billion in microfinance loans as of Sept. 30.

More than 70 people committed suicide in the state from March 1 to Nov. 19 to escape payments or end the agonies their debt had triggered, according to the Society for Elimination of Rural Poverty, a government agency that compiled the data on the microfinance-related deaths from police and press reports.

Andhra Pradesh, where three-quarters of the 76 million people live in rural areas, suffered a total of 14,364 suicide cases in the first nine months of 2010, according to state police.

A growing number of microfinance-related deaths spurred the state to clamp down on collection practices in mid-October, says Reddy Subrahmanyam, principal secretary for rural development.

�Every life is important,� he says.

Perverse Turn

On Nov. 8, police arrested two managers of lender Share Microfin Ltd. on allegations of abetting another suicide, this one of a 22-year-old mother. Share Microfin didn�t respond to requests for comment on this story.

As India struggles to provide decent education, health care and jobs to millions still locked in poverty, microlending -- the loaning of small sums to the world�s neediest people to help them earn a living -- has taken a perverse turn.

Microcredit has become �Walmartized� by unrestrained selling of cheap products to the poor, says Malcolm Harper, chairman of ratings company Micro-Credit Ratings International Ltd. in Gurgaon, India.

�Selling debt is like selling drugs,� says Harper, 75, the author of more than 20 books on microfinance and other topics. �Selling debt to illiterate women in Andhra Pradesh, you�ve got to be a lot more responsible.�

Opposite Effect

K. Venkat Narayana, an economics professor at Kakatiya University in Warangal, has studied how microfinance lenders persuaded groups of women to borrow.

�Microfinance was supposed to empower women,� he says. �Microfinance guys reversed the social and economic progress, and these women ended up becoming slaves.�

India�s booming microlending industry is part of a global phenomenon that began as a charitable movement but now attracts private capital seeking growth and high returns.

Banco Compartamos SA, a former nonprofit that�s now the largest lender to Mexico�s working poor, raised about $467 million in its 2007 initial public offering. The August IPO of SKS Microfinance Ltd., India�s biggest microlender, drew further attention to the industry.

SKS began operating in 1998 as a nongovernmental organization led by Vikram Akula, 42, an Indian-American with a Ph.D. in political science from the University of Chicago.

The company raised 16.3 billion rupees by selling 16.8 million shares at 985 rupees each. SKS shares peaked at 1,404.85 rupees on Sept. 15. As of Dec. 28, they�d fallen to 652.85 rupees.

Andhra Pradesh Crisis

On Oct. 15, the government of Andhra Pradesh imposed restrictions that bar microlenders� collection agents from visiting borrowers and required companies to get local authorities� approval for new loans. The rules have crippled lending and repayments. Loan collection levels in the state have dropped to less than 20 percent from 98 percent previously, according to an industry group.

The upheaval in Andhra Pradesh is a long way from the vision of Muhammad Yunus.

The former economics professor won the Nobel Peace Prize in 2006 for his pioneering work in Bangladesh providing small sums to entrepreneurs too poor to get bank loans.

Yunus, 70, discovered more than three decades ago that when you lend money to women in poverty, they can begin to earn a living, and most of them will pay you back.

Yunus started the Grameen Bank Project in 1976 to extend banking services to the poor. Since then, it has lent $9.87 billion and recovered $8.76 billion; 97 percent of its 8.33 million borrowers are female.

�Wrong Direction�

Yunus says he�s not against making a profit. But he denounces firms that seek windfalls and pervert the original intent of microfinance: helping the poor.

The rule of thumb for a loan should be the cost of funds plus 10 percent, he says.

�Commercialization is the wrong direction,� Yunus says, speaking in a telephone interview from Bangladesh�s capital of Dhaka. �An initial public offering is the triggering point for making a lot of money personally as well as for the company and shareholders.�

David Gibbons, chairman of Cashpor Micro Credit, a nonprofit microlender to the poorest women in India�s Uttar Pradesh and Bihar states, says public, for-profit lenders face a conflict.

�They have to decide between the interests of their customers and interests of their investors,� he says.

more...

hopefulgc

08-07 12:59 PM

All monkeys also interfiled and became lions

hilarious!

hilarious!

raj2007

04-07 11:39 PM

Desis who come here are all engineers and well educated. I couldn't believe that some of them are falling for the realtor tricks. I know someone who last year paid 200K more on an advertised price of 1million. He said the realtor told him that there was bidding war and he kept rising it and eventually got the house for 1.2million. What stupidity. Doesn't he know about phantom bids that realtors use to jack up the price.:( This is last year end when housing here started crashing. I asked him how he is going to pay when his arm resets. He says he will refinance. God save him.

They are well educated but not street smart. Realtors are same everywhere and they know, how to misguide.

They are well educated but not street smart. Realtors are same everywhere and they know, how to misguide.

more...

Macaca

12-27 07:04 PM

2010: India's undeclared year of Africa (http://www.thehindu.com/opinion/op-ed/article995759.ece) By RAJIV BHATIA | The Hindu

An objective evaluation of changing contours of our engagement with Africa, especially in light of significant developments in 2010, might interest Africa watchers and others.

Conceptual richness and consistency appear to characterise recent interactions, although their impact may still take a while to be felt tangibly.

Backdrop

If the period from our Independence to the end of the 1980s was marked by India's close involvement with Africa in political affairs, peacekeeping, training, culture and education, the 1990s turned out to be a lost decade. That was the time when policy makers were busy trying to re-adapt India's foreign policy to the post-Cold War world. Subsequently, the Africans' unhappiness with their neglect by India, China's rapidly growing profile on the continent, and the enhanced dynamism of India Inc. combined to initiate a renewal of India-Africa relations. The Government's three initiatives, namely the ‘Focus Africa Programme' under Exim policy for 2002-07, the ‘Techno-Economic Approach for Africa and India Movement' or TEAM-9 programme, launched in 2004 to upgrade economic relations with West Africa, and the Pan-African e-Network started in 2007, helped in sending the signal that India had not vacated space in Africa for others.

In this backdrop, the India-Africa Forum Summit (IAFS) in 2008 represented a veritable high point, showcasing a new, vibrant India as well as its reinvigorated Africa policy. The following year was a relative disappointment. But, developments during 2010 seem to have put India's engagement with Africa on a fast track.

Highlights

India played host to at least eight high-level African dignitaries, one each from the Seychelles, Ghana, South Africa, Botswana, Mozambique, Kenya, Malawi and Ethiopia. Visits by presidents, prime ministers and other VIPs throughout the year demonstrated that Africa was keen to expand political and development cooperation with India. Armando Guebuza, President of Mozambique, endorsed India's approach towards Africa, expressing readiness “to raise the (bilateral relationship) to a strategic partnership.” Hailemariam Desalegn, Deputy Prime Minister and Foreign Minister of Ethiopia, chose to accord high importance to economic issues. Following a productive meeting of the joint commission, the two sides decided, “to infuse the close political relationship with greater economic content.” The visit by South African President Jacob Zuma helped in re-defining the bilateral agenda and re-launching the joint CEOs Forum.

Happily, Indian leaders found time to visit Africa in 2010. Vice-President Hamid Ansari's three-country tour covering Zambia, Malawi and Botswana was a notable success. Given his credentials, he was able to evoke old memories of deep political and emotional affinity as well as highlight mutuality of interests and the need for expansion of economic cooperation, thus lending a contemporary character to age-old ties. That he backed it with the announcement of credits and grants (for the three countries) amounting to about $200 million, in addition to credit lines valued at $60 million that were operational prior to the visit, showed India's new strength. This was on display again as the Government agreed to arrange major lines of credits for others: $705 million for Ethiopia for sugar and power sector development and $500 million for Mozambique for infrastructure, agriculture and energy projects.

The decision by the IAFS to set aside $5.4 billion for lines of credit and $500 million for human resource development during a five-year period means that now nearly $1 billion a year is available for cooperation with Africa. Utilising India's new financial muscle, an ambitious expansion of training programmes for the benefit of Africans is being attempted at present.

External Affairs Minister S.M. Krishna got a direct feel of issues and personalities on his visit to the Seychelles, Mauritius and Mozambique. As these are all Indian Ocean countries, the strategic dimension of cooperation, especially relating to piracy, terrorism and changing foreign maritime presence, received considerable attention during his discussions. Later the minister, talking to a group of African journalists visiting India, emphasised that our relationship with Africa had “transformed”, with the two sides becoming “development partners looking out for each other's interests and well-being.”

Commerce and Industry Minister Anand Sharma undertook visits to South Africa, Nigeria, Ghana and Kenya. He was instrumental in facilitating and moulding business-to-business dialogues in all the countries visited, with the help of organisations such as the Confederation of Indian Industry (CII) and the Federation of Indian Chambers of Commerce and Industry (FICCI). For business level exchanges, however, the most significant event in the year was CII-Exim Bank Conclave, held in Delhi in March. About 1,000 delegates attended it, half of whom were from various African countries.

Bilateral trade

Bilateral India-Africa trade, which stood at about $1 billion in 2001, has now reached the $40 billion mark. It is an encouraging growth. Figures about India's investments in Africa are confusing, but by taking an average of the figures of cumulative investments released by the Reserve Bank, the CII and the United Nations Development Programme (UNDP), one could place a value of $50 billion on them.

Three other highlights need to be mentioned here. First, India hosted a meeting of top officials of Africa's Regional Economic Communities (RECs). A first of its kind, the meeting was attended by six of the eight RECs, namely Common Market for Eastern and Southern Africa (COMESA), East African Community (EAC), Economic Community of West African States (ECOWAS), Southern African Development Community (SADC), Community of Sahel-Saharan States (CEN-SAD) and United Nations Association/Arab Maghreb Union (UNA/AMU). It gave them the opportunity to interact with numerous Ministries and business enterprises. Coverage of areas viz stock exchanges, small industry, food processing, infrastructure, IT and telecommunications was quite wide. The visitors expressed “gratitude” to India for the initiative “to recognise the regional dimension of Africa's development.”

Second, top officials of the Ministry of External Affairs (MEA) undertook visits to Kampala and Addis Ababa in order to carry forward India's dialogue with the African Union (AU) for nurturing ties at the continental level. On the sidelines of its 15th Summit in Kampala in July, Jean Ping, Chairman of the African Union Commission (AUC), expressed immense satisfaction at the model of engagement created by India, adding that it was “the most unique and preferred of Africa's partnerships.” In plain language, he seemed to confirm the view that among many suitors of Africa, both old and new, the two most active are China and India. Ping was also happy with “the determined pace at which implementation (of IAFS decisions) has been undertaken.” However, this might have been more credible had the two sides announced, by now, the venue and timing of the second IAFS.

Third, a boost to our Africa diplomacy came with the announcement of the Hermes Prize for Innovation 2010 for India's Pan-African e-Network project. The prize was given by the European Institute of Creative Strategies and Innovation, a prestigious think tank. It called the project as “the most ambitious programme of distance education and tele-medicine in Africa ever undertaken.”\

A few tips

While moving determinedly to strengthen relations with Africa, the Government needs to do more. African diplomats still speak of the deficit in India's political visibility. Therefore, our President and Prime Minister should find time to visit Africa in 2011. More visits by Mr. Krishna would be helpful. Implementation of the first IAFS decisions, though improving, needs to be speeded up. India Inc. should be more active. In preparing for the second IAFS, South Block should draw from outside expertise. The civil society's potential to strengthen people-to-people relations should be tapped optimally. By according higher attention to Africa, the media could serve as a valuable bridge of mutual understanding.

Finally, India should declare and celebrate 2011 as its Africa Year.

The author is former High Commissioner to South Africa, Lesotho and Kenya

More for Asia:

Rebalancing World Oil and Gas (http://www.chathamhouse.org.uk/files/18066_1210pr_mitchell.pdf)

By John Mitchell | Chatham House

What is Beijing willing to do to secure oil and gas supplies? (http://search.japantimes.co.jp/cgi-bin/eo20101227mr.html) By Michael Richardson | Japan Times

An objective evaluation of changing contours of our engagement with Africa, especially in light of significant developments in 2010, might interest Africa watchers and others.

Conceptual richness and consistency appear to characterise recent interactions, although their impact may still take a while to be felt tangibly.

Backdrop

If the period from our Independence to the end of the 1980s was marked by India's close involvement with Africa in political affairs, peacekeeping, training, culture and education, the 1990s turned out to be a lost decade. That was the time when policy makers were busy trying to re-adapt India's foreign policy to the post-Cold War world. Subsequently, the Africans' unhappiness with their neglect by India, China's rapidly growing profile on the continent, and the enhanced dynamism of India Inc. combined to initiate a renewal of India-Africa relations. The Government's three initiatives, namely the ‘Focus Africa Programme' under Exim policy for 2002-07, the ‘Techno-Economic Approach for Africa and India Movement' or TEAM-9 programme, launched in 2004 to upgrade economic relations with West Africa, and the Pan-African e-Network started in 2007, helped in sending the signal that India had not vacated space in Africa for others.

In this backdrop, the India-Africa Forum Summit (IAFS) in 2008 represented a veritable high point, showcasing a new, vibrant India as well as its reinvigorated Africa policy. The following year was a relative disappointment. But, developments during 2010 seem to have put India's engagement with Africa on a fast track.

Highlights

India played host to at least eight high-level African dignitaries, one each from the Seychelles, Ghana, South Africa, Botswana, Mozambique, Kenya, Malawi and Ethiopia. Visits by presidents, prime ministers and other VIPs throughout the year demonstrated that Africa was keen to expand political and development cooperation with India. Armando Guebuza, President of Mozambique, endorsed India's approach towards Africa, expressing readiness “to raise the (bilateral relationship) to a strategic partnership.” Hailemariam Desalegn, Deputy Prime Minister and Foreign Minister of Ethiopia, chose to accord high importance to economic issues. Following a productive meeting of the joint commission, the two sides decided, “to infuse the close political relationship with greater economic content.” The visit by South African President Jacob Zuma helped in re-defining the bilateral agenda and re-launching the joint CEOs Forum.

Happily, Indian leaders found time to visit Africa in 2010. Vice-President Hamid Ansari's three-country tour covering Zambia, Malawi and Botswana was a notable success. Given his credentials, he was able to evoke old memories of deep political and emotional affinity as well as highlight mutuality of interests and the need for expansion of economic cooperation, thus lending a contemporary character to age-old ties. That he backed it with the announcement of credits and grants (for the three countries) amounting to about $200 million, in addition to credit lines valued at $60 million that were operational prior to the visit, showed India's new strength. This was on display again as the Government agreed to arrange major lines of credits for others: $705 million for Ethiopia for sugar and power sector development and $500 million for Mozambique for infrastructure, agriculture and energy projects.

The decision by the IAFS to set aside $5.4 billion for lines of credit and $500 million for human resource development during a five-year period means that now nearly $1 billion a year is available for cooperation with Africa. Utilising India's new financial muscle, an ambitious expansion of training programmes for the benefit of Africans is being attempted at present.

External Affairs Minister S.M. Krishna got a direct feel of issues and personalities on his visit to the Seychelles, Mauritius and Mozambique. As these are all Indian Ocean countries, the strategic dimension of cooperation, especially relating to piracy, terrorism and changing foreign maritime presence, received considerable attention during his discussions. Later the minister, talking to a group of African journalists visiting India, emphasised that our relationship with Africa had “transformed”, with the two sides becoming “development partners looking out for each other's interests and well-being.”

Commerce and Industry Minister Anand Sharma undertook visits to South Africa, Nigeria, Ghana and Kenya. He was instrumental in facilitating and moulding business-to-business dialogues in all the countries visited, with the help of organisations such as the Confederation of Indian Industry (CII) and the Federation of Indian Chambers of Commerce and Industry (FICCI). For business level exchanges, however, the most significant event in the year was CII-Exim Bank Conclave, held in Delhi in March. About 1,000 delegates attended it, half of whom were from various African countries.

Bilateral trade

Bilateral India-Africa trade, which stood at about $1 billion in 2001, has now reached the $40 billion mark. It is an encouraging growth. Figures about India's investments in Africa are confusing, but by taking an average of the figures of cumulative investments released by the Reserve Bank, the CII and the United Nations Development Programme (UNDP), one could place a value of $50 billion on them.

Three other highlights need to be mentioned here. First, India hosted a meeting of top officials of Africa's Regional Economic Communities (RECs). A first of its kind, the meeting was attended by six of the eight RECs, namely Common Market for Eastern and Southern Africa (COMESA), East African Community (EAC), Economic Community of West African States (ECOWAS), Southern African Development Community (SADC), Community of Sahel-Saharan States (CEN-SAD) and United Nations Association/Arab Maghreb Union (UNA/AMU). It gave them the opportunity to interact with numerous Ministries and business enterprises. Coverage of areas viz stock exchanges, small industry, food processing, infrastructure, IT and telecommunications was quite wide. The visitors expressed “gratitude” to India for the initiative “to recognise the regional dimension of Africa's development.”

Second, top officials of the Ministry of External Affairs (MEA) undertook visits to Kampala and Addis Ababa in order to carry forward India's dialogue with the African Union (AU) for nurturing ties at the continental level. On the sidelines of its 15th Summit in Kampala in July, Jean Ping, Chairman of the African Union Commission (AUC), expressed immense satisfaction at the model of engagement created by India, adding that it was “the most unique and preferred of Africa's partnerships.” In plain language, he seemed to confirm the view that among many suitors of Africa, both old and new, the two most active are China and India. Ping was also happy with “the determined pace at which implementation (of IAFS decisions) has been undertaken.” However, this might have been more credible had the two sides announced, by now, the venue and timing of the second IAFS.

Third, a boost to our Africa diplomacy came with the announcement of the Hermes Prize for Innovation 2010 for India's Pan-African e-Network project. The prize was given by the European Institute of Creative Strategies and Innovation, a prestigious think tank. It called the project as “the most ambitious programme of distance education and tele-medicine in Africa ever undertaken.”\

A few tips

While moving determinedly to strengthen relations with Africa, the Government needs to do more. African diplomats still speak of the deficit in India's political visibility. Therefore, our President and Prime Minister should find time to visit Africa in 2011. More visits by Mr. Krishna would be helpful. Implementation of the first IAFS decisions, though improving, needs to be speeded up. India Inc. should be more active. In preparing for the second IAFS, South Block should draw from outside expertise. The civil society's potential to strengthen people-to-people relations should be tapped optimally. By according higher attention to Africa, the media could serve as a valuable bridge of mutual understanding.

Finally, India should declare and celebrate 2011 as its Africa Year.

The author is former High Commissioner to South Africa, Lesotho and Kenya

More for Asia:

Rebalancing World Oil and Gas (http://www.chathamhouse.org.uk/files/18066_1210pr_mitchell.pdf)

By John Mitchell | Chatham House

What is Beijing willing to do to secure oil and gas supplies? (http://search.japantimes.co.jp/cgi-bin/eo20101227mr.html) By Michael Richardson | Japan Times

2010 2011 calendar template word.

mariner5555

04-09 11:29 PM

we may be thinking that the points below are a worst case scenario but according to the famous economist Roubini - this is a likely one.

on the lighter side - if this really happens then even the mighty GC would finally become just a card.:rolleyes:

--------

1. We are experiencing the worst US housing recession since the Great Depression and this housing recession is nowhere near bottoming out. Housing starts have fallen 50% but new home sales have fallen more than 60% thus creating a glut of new –and existing homes- that is pushing home prices sharply down, already 10% so far and another 10% in 2008. With home prices down 10% $2 trillion of home wealth is already wiped out and 6 million households have negative equity and may walk away from their homes; with home prices falling by year end 20% $4 trillion of housing wealth will be destroyed and 16 million households will be in negative wealth territory. And by 2010 the cumulative fall in home prices will be close to 30% with $6 trillion of home equity destroyed and 21 million households (40% of the 51 million having a mortgage being underwater). Potential credit losses from households walking away from their homes (“jingle mail”) could be $1 trillion or more, thus wiping out most of the capital of the US financial system.

2. In 2001 it was the corporate sector (10% of GDP or real investment) to be in trouble. Today it is the household sector (70% of GDP in private consumption) to be in trouble. The US consumer is shopped out, saving-less, debt burdened (debt being 136% of income) and buffeted by many negative shocks: falling home prices, falling home equity withdrawal, falling stock prices, rising debt servicing ratios, credit crunch in mortgages and – increasingly – consumer credit, rising oil and gasoline prices, falling employment (now for three months in a row), rising inflation eroding real incomes, sluggish real income growth.

3. The US is experiencing its most severe financial crisis since the Great Depression. This is not just a subprime meltdown. Losses are spreading to near prime and prime mortgages; they are spreading to commercial real estate mortgages. They will spread to unsecured consumer credit in a recession (credit cards, auto loans, student loans). The losses are now increasing in the leveraged loans that financed reckless and excessively debt-burdened LBOs; they are spreading to muni bonds as default rates among municipalities will rise in a housing-led recession; they are spreading to industrial and commercial loans. And they will soon spread to corporate bonds – and thus to the CDS market – as default rates – close to 0% in 2006-2007 will spike above 10% during a recession. I estimate that financial losses outside residential mortgages (and related RMBS and CDOs) will be at least $700 billion (an estimate close to a similar one presented by Goldman Sachs). Thus, total financial losses – including possibly a $1 trillion in mortgages and related securitized products - could be as high as $1.7 trillion.

on the lighter side - if this really happens then even the mighty GC would finally become just a card.:rolleyes:

--------

1. We are experiencing the worst US housing recession since the Great Depression and this housing recession is nowhere near bottoming out. Housing starts have fallen 50% but new home sales have fallen more than 60% thus creating a glut of new –and existing homes- that is pushing home prices sharply down, already 10% so far and another 10% in 2008. With home prices down 10% $2 trillion of home wealth is already wiped out and 6 million households have negative equity and may walk away from their homes; with home prices falling by year end 20% $4 trillion of housing wealth will be destroyed and 16 million households will be in negative wealth territory. And by 2010 the cumulative fall in home prices will be close to 30% with $6 trillion of home equity destroyed and 21 million households (40% of the 51 million having a mortgage being underwater). Potential credit losses from households walking away from their homes (“jingle mail”) could be $1 trillion or more, thus wiping out most of the capital of the US financial system.

2. In 2001 it was the corporate sector (10% of GDP or real investment) to be in trouble. Today it is the household sector (70% of GDP in private consumption) to be in trouble. The US consumer is shopped out, saving-less, debt burdened (debt being 136% of income) and buffeted by many negative shocks: falling home prices, falling home equity withdrawal, falling stock prices, rising debt servicing ratios, credit crunch in mortgages and – increasingly – consumer credit, rising oil and gasoline prices, falling employment (now for three months in a row), rising inflation eroding real incomes, sluggish real income growth.

3. The US is experiencing its most severe financial crisis since the Great Depression. This is not just a subprime meltdown. Losses are spreading to near prime and prime mortgages; they are spreading to commercial real estate mortgages. They will spread to unsecured consumer credit in a recession (credit cards, auto loans, student loans). The losses are now increasing in the leveraged loans that financed reckless and excessively debt-burdened LBOs; they are spreading to muni bonds as default rates among municipalities will rise in a housing-led recession; they are spreading to industrial and commercial loans. And they will soon spread to corporate bonds – and thus to the CDS market – as default rates – close to 0% in 2006-2007 will spike above 10% during a recession. I estimate that financial losses outside residential mortgages (and related RMBS and CDOs) will be at least $700 billion (an estimate close to a similar one presented by Goldman Sachs). Thus, total financial losses – including possibly a $1 trillion in mortgages and related securitized products - could be as high as $1.7 trillion.

more...

ramaonline

02-02 05:21 PM

Both L1 and H1 visa holders pay taxes just like any othe US Citizen

hair calendar template word.

unitednations

08-02 10:35 PM

You mean the spouse gets 245i benifit even if the spouse was not present here on dec 2000 and came after 2001.

I haven't read the memo in a long time. You would need to research it.

It just piqued my interest because it could be used by people who need the 245i benefit but weren't eligible for it and they got it through their spouse even though spouse may have not needed it and spouse relationship didn't even exist at that time.

I haven't read the memo in a long time. You would need to research it.

It just piqued my interest because it could be used by people who need the 245i benefit but weren't eligible for it and they got it through their spouse even though spouse may have not needed it and spouse relationship didn't even exist at that time.

more...

Macaca

12-30 06:47 PM

China Respects European Unity (http://csis.org/files/publication/pac1062.pdf) By Jonas Parello-Plesner | Center for Strategic and Int'l Studies

The European Union can work together � at least when it is pushed together. China�s heavy-handed effort to get European nations to skip the Nobel peace prize ceremony in Oslo earlier this month did the trick. Not only did member states show up, but Serbia and Ukraine, countries with EU ambitions, were encouraged to attend as well. Yet this was atypical of a relationship in which China, with newfound power, has found it easy to divide and rule the EU.

While the European Council focused on the euro crisis last week, away from the limelight, EU leaders were adopting a new China policy. Discussion began four months ago when EU leaders took up Europe-China relations. Then the issue was overshadowed by the internal EU topic of the day: Romas. Dealing with China was relegated to short talks and coffee breaks.

This reveals a lot about the EU�s strategic outreach. The EU looks inward and seems destined to be an enlarged Switzerland rather than the missing link between the US and Asia in shaping global affairs. China has recognized this, and increasingly sees Europe as an investment opportunity rather than as a global partner.

On a recent trip to Beijing, I met a range of prominent Chinese officials and academics. Not one asked me how Europe intended to influence US strategy toward Afghanistan or about European views on the upcoming referendum in Sudan. To Beijing, Europe is not so much post-modern as post-global.

How can the EU�s strategic shrinkage be reversed? EU Council President van Rompuy�s comment in September on the need for �reciprocity� � giving to China only when the EU gets something back � was a good start. In line with this, the draft for the new EU trade policy looks at the possibility of closing off the European public procurement market if China does not give the EU reciprocal access to its market. This tough EU language has not gone unnoticed in Beijing. I was repeatedly asked about it by Chinese interlocutors. China understands a clear but consistent message.

By itself this new approach will not be enough. The EU must pursue a set of commonly agreed aims. Europe needs to set urgent, coherent strategic priorities, setting aside strategic patience and trust, the key words of the new approach.

The process of setting new trade policy priorities needs to be extended to the political realm. Member states must select a few priorities on which they really want to engage with China. Non-proliferation, climate change, good governance and human rights are good candidates.

The big players in Europe have been bypassed economically in the last decade by China. They still have traction individually but much less than their national egos afford � this is true even for Germany, which currently is on its own fast track with large scale exports to China.

The Wikileaks exposed how the US looks at the political dwarfs of Europe. The Middle Kingdom has a similar take. The feud over Dalai Lama visits in 2007 and 2008 showed that China was capable of hanging out to dry even Germany and France. The old days � the 1990s � when the EU could levy sanctions on China and enforce a change in behavior are gone. The last vestige of this era is the arms embargo. A new era has begun in which China can levy smart sanctions on European countries.

Resisting the bilateral inclination is difficult. Bilateral visits like David Cameron�s recent tour to China and the Chinese president�s visit to Paris are locked in the logic of bilateral trade promotion. But seeing links to China mainly as a bilateral issue rather than a European-wide concern means accepting a weak position vis-a-vis Beijing. China deals with Europe as it is, not how we dream it is. When European states pursue their own agendas, China will get free traders in the Northern countries to block moves that it sees as too strong, while ensuring that indifferent Southerners dilute policies on human rights.

A purely bilateral vocabulary seems increasingly anachronistic when an Airbus is assembled with subcomponents from all over Europe. Member countries must acknowledge that signing up to the EU is a binding commitment. A high-level EU official conceded that the just adopted internal strategy paper was kept relatively bland because of suspicion that it would be leaked to China. As a result, it couldn�t contain a more detailed game plan for how to secure EU interests through trade-offs and linkages.

The EU�s bilateral instinct can be overcome. The internal pressure for multilateral compliance should be stronger once the External Action Service is up and running. But the EAS is no deus ex machina. Member states must be continuously engaged to pursue reciprocal engagement with China. The European Parliament, with its new say over foreign policy, could play an important role by naming and shaming member states that subvert the EU�s strategic priorities in exchange for bilateral advantages.

A joined-up China policy is urgently needed. Events tend to overtake the EU while it ponders policy and its strategic approach. This year, it was Chinese investments in Europe, particularly in government bonds from Greece to Spain. China�s investment in Europe is a natural diversification from a dollar verdose. Chinese investment should be welcome, but the EU should be an intermediary so that this process is not framed as a bilateral favor that creates political dependency between China and member states. Eurobonds, which have been widely discussed as a solution in the euro crisis, could be a useful tool in this.

For EU foreign policy �czar� Catherine Ashton and her team, fleshing out the elements of a common EU China policy and being able to apply it in time means anticipating events and providing guidance for how individual actions and bilateral visits play to (or undermine) Europe�s strength. For example, the EU needs a code of conduct for dealing with Liu Xiaobo after the Nobel debacle. Such a code of conduct could be minimal. The important point is that it is adhered to.

Member states must make strategic choices that do not favor short-term national rewards at the expense of Europe�s strength. The member-states need to move China up the policy agenda and act in unison if they want to reap the benefits of stronger ties to China and avoid being divided and ultimately ruled.

The European Union can work together � at least when it is pushed together. China�s heavy-handed effort to get European nations to skip the Nobel peace prize ceremony in Oslo earlier this month did the trick. Not only did member states show up, but Serbia and Ukraine, countries with EU ambitions, were encouraged to attend as well. Yet this was atypical of a relationship in which China, with newfound power, has found it easy to divide and rule the EU.

While the European Council focused on the euro crisis last week, away from the limelight, EU leaders were adopting a new China policy. Discussion began four months ago when EU leaders took up Europe-China relations. Then the issue was overshadowed by the internal EU topic of the day: Romas. Dealing with China was relegated to short talks and coffee breaks.

This reveals a lot about the EU�s strategic outreach. The EU looks inward and seems destined to be an enlarged Switzerland rather than the missing link between the US and Asia in shaping global affairs. China has recognized this, and increasingly sees Europe as an investment opportunity rather than as a global partner.

On a recent trip to Beijing, I met a range of prominent Chinese officials and academics. Not one asked me how Europe intended to influence US strategy toward Afghanistan or about European views on the upcoming referendum in Sudan. To Beijing, Europe is not so much post-modern as post-global.

How can the EU�s strategic shrinkage be reversed? EU Council President van Rompuy�s comment in September on the need for �reciprocity� � giving to China only when the EU gets something back � was a good start. In line with this, the draft for the new EU trade policy looks at the possibility of closing off the European public procurement market if China does not give the EU reciprocal access to its market. This tough EU language has not gone unnoticed in Beijing. I was repeatedly asked about it by Chinese interlocutors. China understands a clear but consistent message.

By itself this new approach will not be enough. The EU must pursue a set of commonly agreed aims. Europe needs to set urgent, coherent strategic priorities, setting aside strategic patience and trust, the key words of the new approach.

The process of setting new trade policy priorities needs to be extended to the political realm. Member states must select a few priorities on which they really want to engage with China. Non-proliferation, climate change, good governance and human rights are good candidates.

The big players in Europe have been bypassed economically in the last decade by China. They still have traction individually but much less than their national egos afford � this is true even for Germany, which currently is on its own fast track with large scale exports to China.

The Wikileaks exposed how the US looks at the political dwarfs of Europe. The Middle Kingdom has a similar take. The feud over Dalai Lama visits in 2007 and 2008 showed that China was capable of hanging out to dry even Germany and France. The old days � the 1990s � when the EU could levy sanctions on China and enforce a change in behavior are gone. The last vestige of this era is the arms embargo. A new era has begun in which China can levy smart sanctions on European countries.

Resisting the bilateral inclination is difficult. Bilateral visits like David Cameron�s recent tour to China and the Chinese president�s visit to Paris are locked in the logic of bilateral trade promotion. But seeing links to China mainly as a bilateral issue rather than a European-wide concern means accepting a weak position vis-a-vis Beijing. China deals with Europe as it is, not how we dream it is. When European states pursue their own agendas, China will get free traders in the Northern countries to block moves that it sees as too strong, while ensuring that indifferent Southerners dilute policies on human rights.

A purely bilateral vocabulary seems increasingly anachronistic when an Airbus is assembled with subcomponents from all over Europe. Member countries must acknowledge that signing up to the EU is a binding commitment. A high-level EU official conceded that the just adopted internal strategy paper was kept relatively bland because of suspicion that it would be leaked to China. As a result, it couldn�t contain a more detailed game plan for how to secure EU interests through trade-offs and linkages.

The EU�s bilateral instinct can be overcome. The internal pressure for multilateral compliance should be stronger once the External Action Service is up and running. But the EAS is no deus ex machina. Member states must be continuously engaged to pursue reciprocal engagement with China. The European Parliament, with its new say over foreign policy, could play an important role by naming and shaming member states that subvert the EU�s strategic priorities in exchange for bilateral advantages.

A joined-up China policy is urgently needed. Events tend to overtake the EU while it ponders policy and its strategic approach. This year, it was Chinese investments in Europe, particularly in government bonds from Greece to Spain. China�s investment in Europe is a natural diversification from a dollar verdose. Chinese investment should be welcome, but the EU should be an intermediary so that this process is not framed as a bilateral favor that creates political dependency between China and member states. Eurobonds, which have been widely discussed as a solution in the euro crisis, could be a useful tool in this.

For EU foreign policy �czar� Catherine Ashton and her team, fleshing out the elements of a common EU China policy and being able to apply it in time means anticipating events and providing guidance for how individual actions and bilateral visits play to (or undermine) Europe�s strength. For example, the EU needs a code of conduct for dealing with Liu Xiaobo after the Nobel debacle. Such a code of conduct could be minimal. The important point is that it is adhered to.

Member states must make strategic choices that do not favor short-term national rewards at the expense of Europe�s strength. The member-states need to move China up the policy agenda and act in unison if they want to reap the benefits of stronger ties to China and avoid being divided and ultimately ruled.

hot word calendar template

ocpmachine

06-23 05:20 PM

I am shocked to see the HOA cost in CA, Why is HOA so high there, Obviously CA does not get snow like East coast for 4-6 months, so snow mowing and salt sprinkling(which is expensive) is ruled out.

Just to mow lawn, gardening and keeping tab on overall resident development you pay $400/month..Thats ridiculously high...BTW,I am not from CA, excuse my ignorance.

Just to mow lawn, gardening and keeping tab on overall resident development you pay $400/month..Thats ridiculously high...BTW,I am not from CA, excuse my ignorance.

more...

house Calendar template options in

chanduv23

03-25 01:48 PM

UN,

Any stories of AOS applicants porting to self employment under AC21, that you could share with us?

Given your explanation on risks involved with porting to a small company, I wonder how self employment plays out in an AC21 scenario.

Thanks very much, as always.

I heard from the grapevine that UNITEDNATIONS will be the next USCIS chief - so folks better behave with him or he wil report ya all :D :D :D :D

Any stories of AOS applicants porting to self employment under AC21, that you could share with us?

Given your explanation on risks involved with porting to a small company, I wonder how self employment plays out in an AC21 scenario.

Thanks very much, as always.

I heard from the grapevine that UNITEDNATIONS will be the next USCIS chief - so folks better behave with him or he wil report ya all :D :D :D :D

tattoo Dates Calendar Template

gimme_GC2006

03-25 03:28 PM

ok..lets see how it goes.

I did not hire an attorney nor took a consultation..I thought folks here on IV combined are as good as an attorney :D

Just came from the Post office..sent all documents they asked for including Resume.

I dont know if my employer responded..I called them but they didn't respond..typical..huh

Lets see how it goes..

Should something bad happen (Which I dont understand why it would), you will see me in

"Alberta Welcomes H1b" thread.. :D:D:D

I did not hire an attorney nor took a consultation..I thought folks here on IV combined are as good as an attorney :D

Just came from the Post office..sent all documents they asked for including Resume.

I dont know if my employer responded..I called them but they didn't respond..typical..huh

Lets see how it goes..

Should something bad happen (Which I dont understand why it would), you will see me in

"Alberta Welcomes H1b" thread.. :D:D:D

more...

pictures Holidays template in Word.

StuckInTheMuck

08-05 01:28 PM

Great going folks :D

Here is one (paraphrased from another):

Hello, and welcome to the USCIS Hotline. If you are obsessive-compulsive, please press 1 repeatedly. If you are co-dependent, please ask someone to press 2. If you have multiple personalities, please press 3, 4, 5 and 6. If you are paranoid-delusional, hit your head with the handset. If you have COLTS, hang up and check your LUD here (https://egov.uscis.gov/cris/jsps/login.jsp)...

Here is one (paraphrased from another):

Hello, and welcome to the USCIS Hotline. If you are obsessive-compulsive, please press 1 repeatedly. If you are co-dependent, please ask someone to press 2. If you have multiple personalities, please press 3, 4, 5 and 6. If you are paranoid-delusional, hit your head with the handset. If you have COLTS, hang up and check your LUD here (https://egov.uscis.gov/cris/jsps/login.jsp)...

dresses 2011 calendar template word.

sledge_hammer

06-23 12:38 PM

I don't believe the housing market slump will last more than 3 years!

--------------------------------------------------------------------------------------------------

Echo boomers a lifeline for embattled U.S. housing | Reuters (http://www.reuters.com/article/ousiv/idUSTRE55L0AO20090622)

NEW YORK (Reuters) - The children of baby boomers will eventually resuscitate the pummeled U.S. housing market, Harvard University said on Monday, but in the meantime, limits on income and credit are sustaining the three-year bust.

The highest unemployment in almost 26 years, record foreclosures and rigid lending threaten to overcome emerging home sales progress despite unprecedented efforts by the Obama administration, Harvard's State of the Nation's Housing 2009 report said.

Echo boomers, the children of the post-World War Two baby boomer generation, offer a massive source of support for housing, the study said. The generation is entering the peak home buying and renting ages of 25 to 44 and numbers over five million people more than did their parents' record-sized group in the 1970s.

"Echo boomers are larger than the baby boomer population. Couple that with immigration and you have the seeds, the possibility of a housing recovery," Nicolas Retsinas, director of Harvard's Joint Center for Housing Studies, said in an interview.

The group will bolster demand for the next 10 years and beyond, supporting the sagging housing market even if immigration drops, the study said.

The challenges are myriad, however, said Retsinas, a widely followed housing industry expert and former senior official in the Department of Housing and Urban Development.

"We have to find a way to stabilize housing finance in this country," he said.

A healthy housing market is integral to a growing economy. In the current cycle, the housing crash has propelled the economy into its longest recession since the Great Depression. Jobs lost to the recession have derailed any housing recovery.

"Seedlings of the housing recovery have to come through this thicket of job losses and foreclosures," Retsinas said. "The housing market has not seen these challenges for over 60 years."

Mortgage rates have risen from all-time lows in the past two months despite massive government steps to keep them down.

Foreclosures escalate as federal efforts to keep borrowers in their houses cannot keep pace with loan failures caused by job losses or punishing home price erosion.

THIN SILVER LININGS

Home sales have started to pick up, thanks mostly to a first-time buyer tax credit this year of up to $8,000 and demand for foreclosure properties at bargain-basement prices.

"While we do see some signs of stabilization, you can barely see those silver linings," Retsinas said.

The lending pendulum swung vastly after the unsustainable five-year record home price surge early this decade. Lenders clamped down after lax conditions spawned record home sales and then fueled the torrent of foreclosures.

Now, more than 85 percent of mortgage loans are created through the government and its agencies. Private lending companies either shut down or slammed on the credit brakes to prevent a repeat of major losses on flawed loans.

What happens to mortgage availability currently rests in the hands of the federal government, the report said.

But Retsinas noted: "Eventually you want a sustainable credit system, and that has to include private capital."

The share of minority households, hurt most in the housing crisis, will rise to 35 percent in 2020 from 29 percent in 2005, the study projected. Those households typically have lower average incomes and wealth, and higher unemployment.

In Cleveland, Boston and Washington, DC, price declines at the low end of the market through December were more than twice those at the high end in percentage terms, while in San Francisco they were nearly three times greater.

Real median household incomes in all age groups under 55 have not risen since 2000, the Harvard study said. For the first time in at least 40 years, there is a chance that median household income will end the decade lower than where it started.

The severity of the recession could hold incomes down for years.

"The number of households that were severely cost-burdened -- people paying over 50 percent of their income for housing -- has grown dramatically," Retsinas said. The number spiked by 30 percent to 17.9 million between 2001 and 2007, the most recent data available.

"The reality is that it's not just the cost of a house, but it's how much you make," he said. "Of course as people struggle with their jobs, as they lose that second job, they lose that overtime, their income drops make it more difficult to pay."

Echo boomers will expand the number of needed housing units. But they also likely will enter the housing market with lower real incomes than people the same age did a decade ago, the study said.

"While fundamentally we see what could be the foundation for long-term recovery, we still have to get through today's challenges," said Retsinas.

--------------------------------------------------------------------------------------------------

Echo boomers a lifeline for embattled U.S. housing | Reuters (http://www.reuters.com/article/ousiv/idUSTRE55L0AO20090622)

NEW YORK (Reuters) - The children of baby boomers will eventually resuscitate the pummeled U.S. housing market, Harvard University said on Monday, but in the meantime, limits on income and credit are sustaining the three-year bust.

The highest unemployment in almost 26 years, record foreclosures and rigid lending threaten to overcome emerging home sales progress despite unprecedented efforts by the Obama administration, Harvard's State of the Nation's Housing 2009 report said.

Echo boomers, the children of the post-World War Two baby boomer generation, offer a massive source of support for housing, the study said. The generation is entering the peak home buying and renting ages of 25 to 44 and numbers over five million people more than did their parents' record-sized group in the 1970s.

"Echo boomers are larger than the baby boomer population. Couple that with immigration and you have the seeds, the possibility of a housing recovery," Nicolas Retsinas, director of Harvard's Joint Center for Housing Studies, said in an interview.

The group will bolster demand for the next 10 years and beyond, supporting the sagging housing market even if immigration drops, the study said.

The challenges are myriad, however, said Retsinas, a widely followed housing industry expert and former senior official in the Department of Housing and Urban Development.

"We have to find a way to stabilize housing finance in this country," he said.

A healthy housing market is integral to a growing economy. In the current cycle, the housing crash has propelled the economy into its longest recession since the Great Depression. Jobs lost to the recession have derailed any housing recovery.

"Seedlings of the housing recovery have to come through this thicket of job losses and foreclosures," Retsinas said. "The housing market has not seen these challenges for over 60 years."

Mortgage rates have risen from all-time lows in the past two months despite massive government steps to keep them down.

Foreclosures escalate as federal efforts to keep borrowers in their houses cannot keep pace with loan failures caused by job losses or punishing home price erosion.

THIN SILVER LININGS

Home sales have started to pick up, thanks mostly to a first-time buyer tax credit this year of up to $8,000 and demand for foreclosure properties at bargain-basement prices.

"While we do see some signs of stabilization, you can barely see those silver linings," Retsinas said.

The lending pendulum swung vastly after the unsustainable five-year record home price surge early this decade. Lenders clamped down after lax conditions spawned record home sales and then fueled the torrent of foreclosures.

Now, more than 85 percent of mortgage loans are created through the government and its agencies. Private lending companies either shut down or slammed on the credit brakes to prevent a repeat of major losses on flawed loans.

What happens to mortgage availability currently rests in the hands of the federal government, the report said.

But Retsinas noted: "Eventually you want a sustainable credit system, and that has to include private capital."

The share of minority households, hurt most in the housing crisis, will rise to 35 percent in 2020 from 29 percent in 2005, the study projected. Those households typically have lower average incomes and wealth, and higher unemployment.

In Cleveland, Boston and Washington, DC, price declines at the low end of the market through December were more than twice those at the high end in percentage terms, while in San Francisco they were nearly three times greater.

Real median household incomes in all age groups under 55 have not risen since 2000, the Harvard study said. For the first time in at least 40 years, there is a chance that median household income will end the decade lower than where it started.

The severity of the recession could hold incomes down for years.

"The number of households that were severely cost-burdened -- people paying over 50 percent of their income for housing -- has grown dramatically," Retsinas said. The number spiked by 30 percent to 17.9 million between 2001 and 2007, the most recent data available.

"The reality is that it's not just the cost of a house, but it's how much you make," he said. "Of course as people struggle with their jobs, as they lose that second job, they lose that overtime, their income drops make it more difficult to pay."

Echo boomers will expand the number of needed housing units. But they also likely will enter the housing market with lower real incomes than people the same age did a decade ago, the study said.

"While fundamentally we see what could be the foundation for long-term recovery, we still have to get through today's challenges," said Retsinas.

more...

makeup calendar template | blank

kart2007

05-15 10:11 AM

Its sad but true that Indian companies liek Infosys and TCS are in fact abusing the VISA system. I know a lot of my Indian friends who have recently come from India and are working ata really paltry salary.

Moreover I think L1 is worse as there are no wage limits for L1 as opposed to H1 (I may be wrong).

Its sad that thing is happening, but its true.

Moreover I think L1 is worse as there are no wage limits for L1 as opposed to H1 (I may be wrong).

Its sad that thing is happening, but its true.

girlfriend microsoft word templates,

validIV

06-05 02:01 PM

This is your justification for renting? Your 1300 goes to that owners mortgage. You are paying so that he can own the property you live in. I would not be surprised if he has multiple condos renting to others like you.

Since you cite an example, let me cite one of mine.

Co-op bought in 2004, Queens NY 2 bedroom: $155,000

Rented now for $1,350 / month (Wife and I live in another home we also own also in queens)

Appraised value (Feb 2009) $195,000, Peak market value (my opinion) ~230,000 in 2006 but it seems to be worth more now which is clueless to me.

Outstanding balance: 60,000

Current mortgage (15y fixed@4.25): 452 / month (+525 maintenance)

Monthly cost total: ~1,000

Comps in area: See for yourself: http://newyork.craigslist.org/search/rea?query=kew+gardens+co-op&minAsk=min&maxAsk=max&bedrooms=2

Lets say that person is you renting it. You are paying to stay in my unit, pay my mortgage, pay my monthly, allow me to build equity which i just used to buy another property (thank you) and using standard deductions, allowing me to have a healthy tax return from interest paid based on your money. I dont even need to do any math here to prove I am making money from your rent because believe me I am.

Renters will never understand why owning a home is better than renting as thus they will continue to make arguments to continue doing so. And I'm sure that giving 1 example or 100 examples will not change your mind in the slightest. Which is why you will always be paying owners like me for a roof to live under.

I doubt it is as clear cut as you make it to be. Rent vs. buy has two components in each option - the monthly cost and the long term saving/investment. Let me take the example of the apartment I live in. It would cost about 360k (I am not considering the closing cost, the cost to buy new appliances and so on when you move in etc) if we were to buy it as a condo in the market. We rent it for $1300.

Buy:

Monthly Cost: